Overview Of E-Invoice And Streamlining Of E-Invoices

E-invoice in Malaysia marks a significant shift from traditional paper-based invoicing to a digital format. This transition simplifies the entire billing process for businesses across the country.

You’ll find that e-invoicing applies to all taxpayers involved in commercial activities in Malaysia. It covers these transactions:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Business-to-Government (B2G)

The MyInvois Portal, provided by the Inland Revenue Board of Malaysia, offers a free e-invoicing solution. This platform is especially useful if your business lacks an ERP or accounting system.

You’ll appreciate how e-invoicing reduces manual data entry errors and speeds up payment cycles. It also improves your record-keeping, making audits and tax compliance more straightforward.

The Malaysian e-invoice system allows you to choose the most suitable mechanism for transmitting e-invoices to the IRBM. This flexibility ensures you can adapt the system to your specific business needs.

Mistakes And Errors Beginners Make For E-Invoicing

E-invoicing has revolutionized business transactions in Malaysia, but it’s not without its pitfalls for newcomers.

You might find yourself making errors that can lead to invoice rejection, potential fines, or even audits by the Inland Revenue Board of Malaysia (IRBM).

These mistakes can disrupt your cash flow and strain business relationships.

Without the help of e-invoicing software, you’re more likely to stumble into common traps. Incorrect data entry, missing required fields, or using improper formats can all result in your e-invoices being rejected or canceled.

It’s crucial to familiarize yourself with the specific requirements set by Malaysian authorities to ensure smooth, compliant invoicing processes.

Mistake #1: Picking A Subpar E-Invoicing Software

Choosing the best e-invoicing software is crucial for businesses of all sizes. It’s not just a tool; it’s the backbone of your financial operations. A subpar choice can lead to headaches down the road.

When selecting e-invoicing software, consider your business needs carefully. Don’t rush into a decision based solely on price or flashy features.

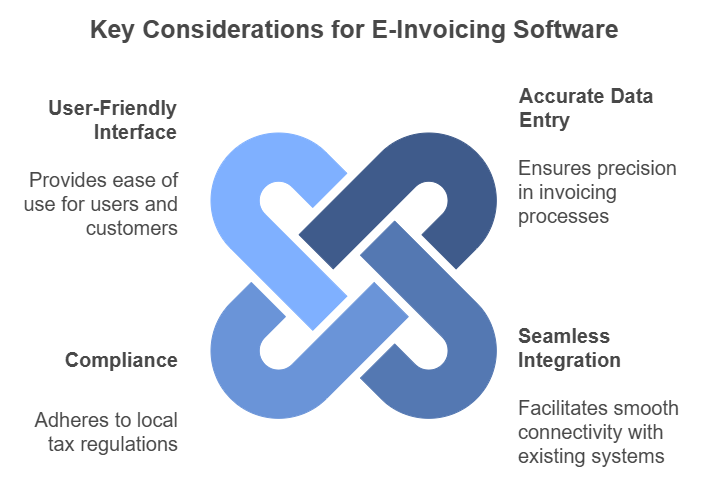

Look for software that offers these key factors:

Beginners often fall into the trap of selecting software that doesn’t align with their business nature. You might be tempted by a solution that works well for a friend’s company, but remember, your needs could be vastly different.

E-invoicing software is essential for streamlining operations and ensuring compliance. For small businesses, it can automate time-consuming tasks. Larger enterprises benefit from its ability to handle high-volume transactions efficiently.

Take time to research and test different options. Many providers offer free trials—use them. Pay attention to how the software handles your specific invoicing scenarios.

Does it support your pricing structure? Can it manage your tax requirements? It’s best to not leave questions like these unanswered.

Remember, the right e-invoicing solution will grow with your business. It should be scalable and adaptable to future changes in regulations and your company’s needs.

Mistake #2: Submitting Inaccurate Or Missing Information

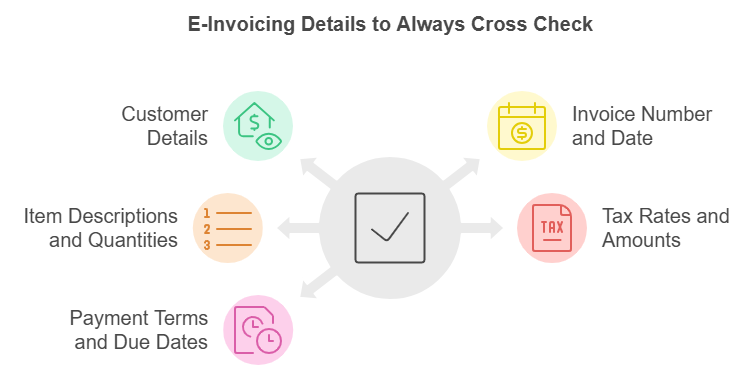

Accuracy is crucial when it comes to e-invoicing. Even the smallest oversight can lead to rejection and delays in processing. You might be surprised by how often seemingly minor details trip up users.

The Tax Identification Number (TIN) is a common stumbling block. Double-check this number every time you submit an invoice. It’s easy to transpose digits or enter an outdated TIN, but these errors can cause significant headaches.

Another frequent issue is entering incorrect amounts. Always verify the totals, subtotals, and individual line items before submission. A misplaced decimal point or typo can throw off your entire invoice and potentially impact your cash flow.

Don’t forget about the mandatory fields. E-invoicing systems often require specific information that might not be part of your usual invoicing process. Make sure you’re familiar with all required fields and fill them out completely.

Here are some key elements to double-check:

Consider implementing a final review step in your e-invoicing process. This extra moment of scrutiny can save you time and frustration in the long run. Remember, the devil is in the details when it comes to e-invoicing accuracy.

Mistake #3: Implementing An Invalid QR Code

Generating an accurate QR code is crucial for successful e-invoicing in Malaysia. After the Inland Revenue Board of Malaysia (IRBM) validates your invoice, they provide a unique QR code. This code serves as a digital signature and plays a vital role in the e-invoicing process.

You must embed this QR code on your invoice before sending it to the buyer. The code allows recipients to verify the invoice’s authenticity and track its progress easily. It’s a key element in ensuring compliance with Malaysia’s new e-invoicing regulations.

If you accidentally embed an incorrect QR code, you’ll face problems. The IRBM system will reject your attempt to complete the issuance process. This mistake can lead to delays, potential fines, and frustrated customers.

To avoid this error:

- Double-check the QR code before embedding it

- Implement a system to automatically insert the correct code

- Train your staff on the importance of QR code accuracy

Remember, the QR code is more than just a formality. It’s a critical component of Malaysia’s e-invoicing system, designed to enhance transparency and efficiency in business transactions.

By paying close attention to this detail, you’ll ensure smoother operations and maintain compliance with the new regulations. Take the time to verify each QR code – it’s a small step that can save you significant headaches down the line.

Mistake #4: Overlooking Formatting

Proper formatting is crucial when submitting e-invoices in Malaysia. The governing body for e-invoicing only accepts documents in XML and JSON formats. While this requirement seems straightforward, many users still make the mistake of submitting e-invoices in incorrect formats.

You might think that as long as the information is there, the format doesn’t matter. This couldn’t be further from the truth. Submitting an e-invoice in the wrong format can lead to automatic rejection, delays in processing, and potential compliance issues.

To avoid this pitfall, always double-check your e-invoice format before submission. Ensure your e-invoicing software is set up to generate files in either XML or JSON. If you’re manually creating e-invoices, familiarize yourself with these formats and use appropriate tools to validate your documents.

Remember, correct formatting goes beyond just the file type. Pay attention to:

- Proper tag usage in XML

- Correct syntax in JSON

- Accurate data placement within the structure

By prioritizing proper formatting, you’ll streamline your e-invoicing process and reduce the risk of rejections. Take the time to understand the required formats and implement systems that consistently produce correctly formatted e-invoices.

Mistake #5: Poor Optimisation And Monitoring

E-invoicing systems can streamline your billing processes, but they’re not set-and-forget solutions. Many users fall into the trap of neglecting ongoing monitoring and optimization after initial implementation.

You might become overly reliant on automation, assuming the software will handle everything flawlessly. This complacency can lead to missed opportunities for improvement and potential errors slipping through unnoticed.

Regular system audits are crucial. Review your e-invoicing workflows periodically to identify bottlenecks or inefficiencies. Look for ways to streamline data entry, improve invoice accuracy, and reduce processing times.

Don’t overlook the importance of proper configuration. Even automated systems can cause headaches if set up incorrectly. Ensure your e-invoicing software aligns with your specific business needs and accounting practices.

Remember, your e-invoicing system is a tool – its effectiveness depends on how well you use and maintain it.

Stay proactive in seeking feedback from your team and customers. Their insights can reveal pain points or suggest improvements you might not have considered.

Continuous refinement of your e-invoicing processes will help you maximize efficiency and accuracy over time.

Solve Your E-Invoicing Problems With Aspert’s AiNexus

Struggling with e-invoicing complexities even after continuous tinkering of your current e-invoicing software?

Aspert’s AiNexus offers a powerful solution to streamline your processes. This user-friendly software is designed with beginners in mind, featuring an intuitive interface that simplifies e-invoice creation and submission.

AiNexus stands out by ensuring full compliance with LHDN (Lembaga Hasil Dalam Negeri) and IRBM (Inland Revenue Board of Malaysia) regulations.

You can rest easy knowing your e-invoices meet all necessary standards, avoiding potential penalties and delays.

Integrating seamlessly with existing ERP systems, AiNexus significantly reduces manual tasks. This automation not only saves time but also minimizes errors, allowing your team to focus on more valuable activities.

By choosing AiNexus, you’re opting for a solution that combines compliance, ease of use, and efficiency.

Interested? Speak to our experts here and we’ll get you up to speed on what you can achieve and solve with our software.

Further reading:

Best Cloud ERP for Small Businesses