The traditional ways of processing invoices are long gone.

The time-consuming processes and susceptibility to human error have made it a challenging endeavor for businesses. With e-invoicing, these issues can be significantly reduced by streamlining procedures and ensuring accuracy.

Over the years, the Malaysian invoicing landscape has evolved tremendously and has shaken hands with the digital world.

Nonetheless, there’s still room for improvement as some businesses have yet to make the full transition to e-invoicing. As such, you’ll see top-end businesses incorporating AI into e-invoicing can further enhance efficiency—making the process faster and more reliable.

By embracing these advancements, your business can save time and reduce errors. The end goal here is to make invoicing less of a burden and more of a streamlined aspect of your business operations.

What Is E-Invoicing Malaysia?

E-invoicing in Malaysia refers to the process of generating, sending, receiving, and storing invoices electronically.

This system eliminates the need for physical paper invoices, promoting efficiency and reducing errors. It is regulated by Malaysian laws and standards to ensure legality and authenticity.

Utilizing e-invoicing in Malaysia is crucial for compliance and transparency. It helps businesses streamline their operations and maintain accurate financial records.

As a business owner, you would want to file your e-invoices properly. Failing to do so can lead to penalties, legal issues, and financial discrepancies.

To learn more about e-invoicing in Malaysia, check out our other e-invoicing articles:

E-Invoicing Guidelines Businesses Should Follow

Adopting e-invoicing in Malaysia is relatively straightforward.

Given today’s technological advancements, the real challenge lies in adhering to the strict guidelines set by authorities. The devil is in the details and businesses must pay attention to avoid avoidable issues with their e-invoices.

Filling E-Invoice Particulars Correctly

One of the easiest things to forget is ensuring your e-invoice includes all mandatory fields.

This might include invoice number, invoice date, supplier’s details, customer’s details, and a clear description of goods or services provided—missing any of these elements can lead to rejection.

It is also crucial to format the e-invoice correctly. The format should comply with IRBM (Inland Revenue Board of Malaysia) rules. Watch out for specifics like using a consistent currency format and ensuring numerical data accuracy.

Ensuring Compliance With Tax Regulations

Regularly update your e-invoicing system. Tax regulations can change, and keeping your system up-to-date will help you stay compliant. Don’t overlook software updates that incorporate these changes.

And since most companies are using software for e-invoicing, the best practice is to use one that is compatible with LHDN (Lembaga Hasil Dalam Negeri) guidelines.

Basically, any software incorporating AiNexus comes pre-validated to ensure compliance, reducing the risk of human error.

Punctuality When Submitting E-Invoices

Honestly, the governing bodies have given business owners ample amount of time to file their e-invoices. Even so, given the overbearing nature of work, it is very easy to lose track of the e-invoicing timeline set by the Malaysian government.

Here’s a short breakdown of the e-invoicing Malaysia implementation timeline as of 2024:

|

And since the deadlines have already been listed by LHDN Malaysia, there is actually very little reason for businesses to miss those deadlines. Still, if your business doesn’t have an individual or a team to manage your e-invoices, having an AI assistant like AiNexus can help.

The guidelines we’ve listed above are the ones that tend to slip out of busy minds. In reality, there is actually a whole document of guidelines business owners should be aware of.

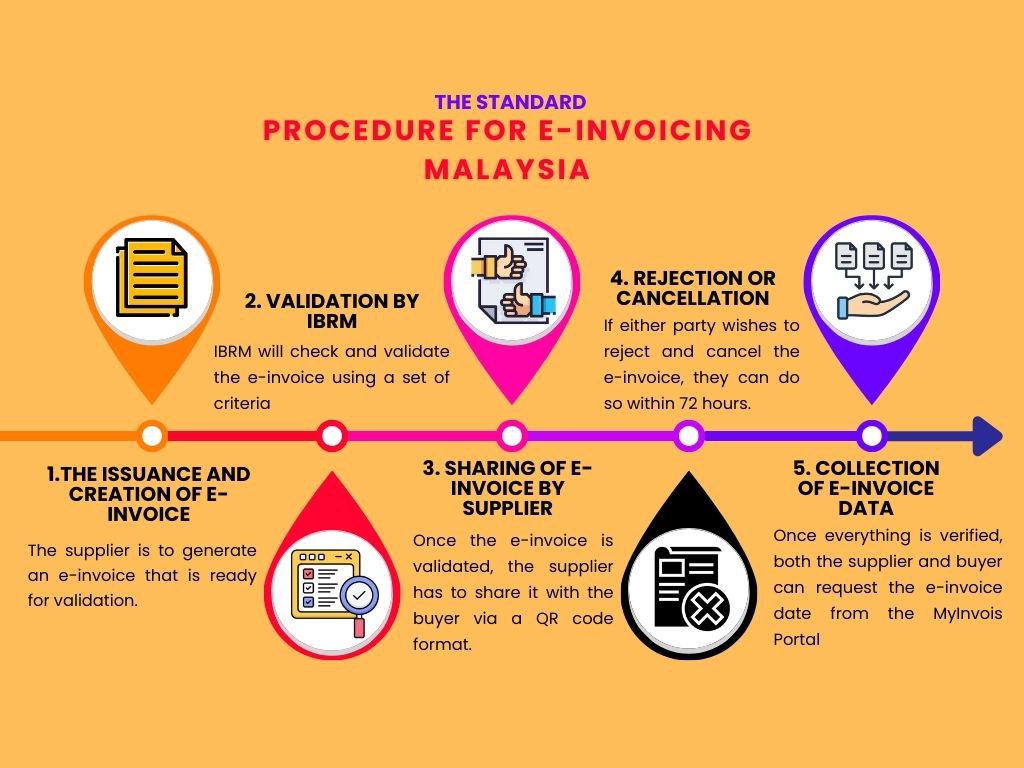

Generally, there’s a standard procedure for filing e-invoices in Malaysia which all business owners should adhere.

The full e-invoicing guideline for Malaysian businesses.

The Standard Procedure For E-Invoicing

E-invoicing in Malaysia typically involves a structured flow that business owners follow to process their invoices effectively. This streamlined procedure not only saves time but ensures transparency and compliance with local regulations.

The Issuance and Creation of E-Invoice

When a transaction occurs, the supplier must promptly generate an e-invoice. This e-invoice is sent to the Inland Revenue Board of Malaysia (IRBM). Utilizing the MyInvois Portal for this process ensures it attains proper validation.

The creation of an e-invoice involves inputting accurate transactional details. This includes the buyer’s and seller’s information, the list of goods or services provided, and the total amount due. Ensuring these details are precise is crucial for the e-invoice to be valid and compliant.

Validation of The E-Invoice by IBRM

When you submit your e-invoice to the MyInvois Portal, IBRM performs a detailed analysis. They evaluate several criteria to ensure accuracy, compliance, and completeness. These may include verifying the authenticity of the digital signature, the correctness of tax calculations, and the match between the supplier’s and buyer’s information.

IBRM also checks for the presence of mandatory fields. Missing or incorrect data will trigger an error response. Once everything checks out, you will obtain a Unique Identifier Number through the same MyInvois Portal.

This process not only standardizes invoices but also helps reduce discrepancies. Accurate validations ensure that both parties meet legal and financial standards. Remember, precision and adherence to guidelines are crucial for successful validation.

Sharing of E-Invoice by Supplier

Once you obtain the verified e-invoice, your next step is to share it with the buyer. It’s crucial to ensure that the invoice reaches the buyer in a timely manner to avoid any delays in processing payments.

You should provide the verified e-invoice through a QR code, which can be easily scanned by the buyer. This QR code will allow the buyer to validate the e-invoice’s existence and status using the MyInvois Portal.

Dealing With Rejection or Cancellation of The E-Invoice

Rejection of an e-invoice may occur from either the supplier or the buyer. Common reasons include discrepancies in amounts, inaccurate details, or non-compliance with required formats. Immediate action is crucial to rectify these issues.

If a cancellation is necessary, note that you have a timeframe of 72 hours to do so. Ensure thorough checks to avoid errors and streamline the invoicing process. Proper coordination between all parties can help mitigate such instances.

Collection of E-Invoice Data Through MyInvois Portal

The MyInvois Portal streamlines the collection of e-invoice data. You, as a supplier or buyer, can easily request the data via this centralized platform.

First, ensure all documents and details are verified. Once confirmed, both the supplier and the buyer may proceed to request the e-invoice data through the portal. This process enhances transparency and efficiency in managing invoices.

Benefits of Implementing AiNexus For E-Invoicing

AI is a term that is thrown around a lot.

We know artificial intelligence is here to help us but to what extent and in this scenario—what is it actually contributing to the entire e-invoicing process?

Trust us, once you’ve integrated AI into your e-invoicing processes and you’ve enjoyed the convenience it provides, you can never go back.

Streamline The Entire E-Invoicing Process

Implementing AiNexus can significantly streamline the e-invoicing process. It reduces processing time by automating invoice creation and submission. This minimizes manual errors and allows your team to focus on other tasks.

Moreover, AiNexus helps cut production costs by reducing the need for extensive manpower. With fewer human resources required, your business can achieve greater efficiency and allocate funds to other essential areas.

Switching to an automated system like AiNexus can improve your company’s cash flow management. It ensures timely invoice submissions and quicker payments. Thus, making your financial operations more efficient and reliable.

Reduce Human Error

Human errors in e-invoicing can lead to significant delays or even total failure of the process. Mistakes such as incorrect data entry, misplaced documents, and arithmetic errors are common. These issues not only disrupt operations but can also cause financial discrepancies.

AiNexus tackles these challenges effectively. By automating key segments of the e-invoicing process, it minimizes the opportunity for human error. This system is particularly helpful for newcomers, making it easier to learn and manage e-invoices accurately.

By reducing manual tasks, AiNexus ensures a seamless workflow, where errors are dramatically reduced. Automated data validation and swift error detection contribute to a more reliable and efficient invoicing system.

Seamless Integration of Third-Party Platforms

AiNexus excels in integrating with various third-party software platforms. This feature allows you to manage e-invoices efficiently without switching between multiple systems. Popular accounting software, ERP systems, and CRM tools can easily connect with AiNexus, creating a unified workflow.

One key advantage is the simplified process of accepting or rejecting e-invoices. With seamless integration, you can review and process invoices directly within your existing systems. This reduces the risk of errors and speeds up your invoicing cycle, enhancing your business’s efficiency.

Read more: 10 Growing Industries That Best Benefit From ERP Systems

Beginner-Friendly Interface For Easy Navigation

E-invoicing can feel daunting, especially if you’re new to financial software. The AiNexus interface is specifically designed to be accessible to newcomers. Its layout is intuitive, allowing you to find the information you need quickly.

This efficient design reduces the process time significantly. You can navigate through the system without getting lost in convoluted menus. Consequently, this makes the entire e-invoicing experience much more straightforward for all users.

Compliant and Parallel With LHDN/IRBM Rules and Guidelines

Earlier in this article, it was mentioned that the governing bodies of Malaysia, such as LHDN and IRBM, are highly particular with their e-invoicing guidelines. Ensuring e-invoicing solutions adhere to these standards is crucial for regulatory compliance.

AiNexus is designed to meet the many rules set by LHDN and IRBM. Key features include automated tax calculations, proper invoice formatting, and secure data storage. This ensures your business remains compliant with Malaysian tax laws.

Being compliant with LHDN and IRBM means your e-invoicing system must be accurate and reliable. You’ll benefit from reduced audit risks and enhanced transparency with authorities. Follow these guidelines for a smoother invoicing process.

Wrapping Up

E-invoicing in Malaysia has transformed the business landscape, making invoicing processes faster, more accurate, and more efficient. By adopting this system, you ensure compliance with local regulations and enhance your operational productivity.

Leveraging digital tools for invoicing not only streamlines your workflow but also reduces errors and administrative burdens. Embrace e-invoicing to stay competitive and forward-thinking in today’s fast-paced market.

And if you have decided, or are unsure where to start your business AI integration for e-invoicing—we’re here to help! Our team specialises in e-invoicing solutions via AiNexus, so feel free to contact us here!