ERP Accounting Software: How Does It Work in Accounting and Finance?

Modern accounting and finance departments require robust tools to manage complex financial operations efficiently. ERP systems serve as the backbone of financial management by integrating various accounting processes into a unified platform and automating core business processes across departments such as finance and HR.

Enterprise resource planning systems (ERPs) automate key financial tasks like accounts payable, accounts receivable, and general ledger management. These comprehensive, integrated software solutions create a centralized database where all financial data is stored, updated, and accessed in real-time.

Financial reporting becomes seamless with ERP solutions. We can generate customized reports, financial statements, and analytics dashboards with just a few clicks, saving countless hours of manual work.

The system enhances data accuracy by eliminating duplicate entries and human errors. When we enter data once, it automatically updates across all relevant modules and reports.

ERP systems strengthen financial compliance by maintaining detailed audit trails and enforcing internal controls. This helps protect against fraud and ensures regulatory requirements are met.

The software optimizes resource allocation through better cash flow management and forecasting capabilities. We can track expenses, monitor budgets, and make data-driven financial decisions more effectively.

Integration with other business functions provides a complete view of financial health. Sales data, inventory costs, and payroll information flow directly into the accounting system, creating a comprehensive financial picture.

Digital transformation in finance becomes achievable as ERP systems enable paperless processes and automated workflows. Teams can collaborate remotely while maintaining security and control over sensitive financial data.

Also, if you want to read more about ERP systems for other industries, check this article:

8 Best ERP System in Malaysia For 2025

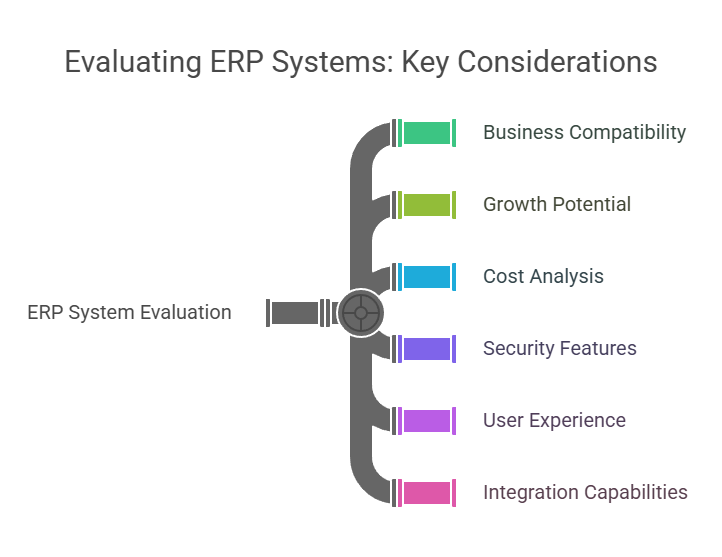

Factors We Consider When Reviewing Enterprise Resource Planning Systems For Accounting And Finance

We prioritize business compatibility when evaluating ERP accounting systems. Each organization has unique workflows and processes, so the chosen system must align seamlessly with existing operations while enhancing operational efficiency.

Growth potential ranks high on our evaluation criteria. A quality ERP system should scale alongside your business, accommodating increased transaction volumes, new subsidiaries, and expanded reporting requirements without requiring replacement.

Cost analysis goes beyond the initial price tag. We examine ongoing subscription fees, implementation costs, training expenses, and potential customization needs to ensure the system fits within budget constraints.

Security features make or break our recommendations. Modern ERP systems must offer robust data encryption, role-based access controls, and comprehensive audit trails to protect sensitive financial information.

User experience directly impacts adoption rates and productivity. We test navigation flows, screen layouts, and reporting interfaces to verify the system remains intuitive for daily accounting tasks.

The interface should strike a balance between functionality and simplicity. Clean dashboards, customizable reports, and automated workflows demonstrate thoughtful design that empowers finance teams to work efficiently.

Integration capabilities prove essential for modern accounting. We verify that each ERP solution connects smoothly with common business tools like CRM systems, payment processors, and banking platforms.

Supporting finance and accounting processes is crucial. The ERP system should cater specifically to the needs of finance teams, managing financial operations effectively and ensuring all financial data is centralized for better decision-making.

Best ERP Accounting Software To Have Going Into 2025

Selecting the right ERP software among countless options can feel like navigating through a maze. ERP software enables businesses to manage and integrate essential operations and processes within a single platform. We’ve analyzed the top performers to bring you the most reliable ERP accounting software solutions for 2025.

Here are some of our recommendations:

1. SAP Business One

Pros: Comprehensive Financial Management, Real-time updates and Insights.

Cons: Rigid Financial Report Formats, Consolidation Challenges.

Pricing: Enterprise Package (5+ users): Price upon request.

Usability: Designed to be intuitive and easy to use.

SAP Business One stands as a comprehensive ERP solution crafted specifically for small and medium-sized enterprises. We’ve found it particularly effective in managing core business operations from a single platform.

The software excels in financial management, offering robust accounting tools that streamline daily transactions and reporting. It generates comprehensive financial reports essential for understanding a company’s financial health, guiding decision-making, and ensuring compliance with regulatory standards. Its user-friendly interface makes complex financial processes more manageable for teams of all skill levels.

The centralized purchasing system enables precise control over procurement processes. We appreciate how it maintains detailed item information, price lists, and tax data while providing instant access to account balances.

SAP Business One’s manufacturing capabilities shine through its production planning features. The system integrates smoothly with other modules, ensuring consistent data flow across departments.

For businesses in Malaysia, Fast Track serves as the exclusive SAP Business One Gold Partner. Their expertise in implementing SAP B1 solutions spans across manufacturing, retail, and corporate sectors.

The cloud-based deployment option offers flexibility and scalability, making it easier for growing businesses to adapt the system to their changing needs. Teams can access critical business data securely from anywhere, enhancing collaboration and decision-making.

2. QuickBooks

Pros: Multi-currency Support, Bank Connectivity

Cons: Limited File Size And Users.

Pricing: RM149.99 monthly subscription (last checked 2023, pricing may have changed)

Usability: Multiple device compatibility, No double entry required.

QuickBooks stands as a powerful accounting software designed specifically for finance and accounting tasks in small to medium-sized businesses. While not a full ERP system, it excels in financial management and bookkeeping tasks.

Intuit’s AI-powered automation helps streamline common bookkeeping tasks. We find this particularly useful for businesses looking to reduce manual data entry and focus more on growth.

The platform offers seamless integration with bank accounts and credit cards. This feature automatically categorizes transactions and maintains accurate financial records with minimal effort.

QuickBooks shines in its reporting capabilities. Users can generate profit and loss statements, balance sheets, and cash flow reports with just a few clicks.

The software includes built-in payment processing that accepts credit cards and bank transfers. This integration speeds up the payment collection process and improves cash flow management.

Small businesses benefit from QuickBooks’ scalable pricing tiers. Each tier adds more advanced features as companies grow and their needs evolve.

3. Certinia

Pros: Comprehensive Suite Of Tools, Multi-Currency Support.

Cons: Complexity Of Features, Pricing can be higher compared to some competitors, Limited Customization.

Pricing: RM149.99 monthly subscription (last checked 2023, pricing may have changed)

Usability: Relatively easy to use.

Certinia stands as a powerful ERP solution built natively on the Salesforce platform, making it uniquely positioned for businesses seeking seamless integration with their existing Salesforce environment.

The software excels at streamlining financial operations through its comprehensive set of features. Its flexible general ledger adapts to complex accounting needs, while automated billing processes reduce manual workload and potential errors.

What sets Certinia apart is its real-time collaboration capabilities. Teams can track conversations alongside transactions, accounts, and reports, creating a unified workspace that enhances productivity and communication.

Built for growth and scalability, Certinia ERP Cloud offers multi-currency support and robust financial reporting tools. These features prove essential for businesses operating across multiple regions or planning international expansion.

The platform’s integration with Salesforce creates a single source of data, eliminating the need to switch between different systems. Customer records, user experiences, and analytics remain consistent throughout the platform.

We’ve seen Certinia transform financial management for service-based businesses by combining modern technology with practical functionality. Its design focuses on advancement and easy configuration, making it adaptable to changing business needs.

4. Workday

Pros: Improved Reporting, Enhanced Data Integrity.

Cons: Steep Learning Curve, UI Issue.

Pricing: Workday does not publicly disclose its pricing. Contact Workday directly for a custom quote.

Usability: Improved efficiency after familiarization, Mobile app issues.

Workday stands as a powerful cloud-based enterprise software solution that unifies financial management and human capital management into one seamless platform. Its modern SaaS approach transforms how organizations handle their accounting, procurement, and analytics needs. Similarly, Oracle ERP Cloud offers comprehensive features such as financial management, human resources management, and supply chain management, emphasizing its scalability and cloud-based delivery model.

The platform’s AI-driven automation sets it apart from traditional ERP systems. Workday’s intelligent features monitor journal entries, detect anomalies, and provide spend recommendations – making financial processes faster and more accurate.

Real-time insights and analytics give finance teams unprecedented visibility into their operations. We find the unified approach particularly valuable, as it eliminates the need to switch between multiple systems for different financial tasks.

Workday’s enterprise management cloud platform offers greater agility than traditional ERP solutions. Its modern architecture enables faster updates and smoother integrations with existing business systems.

Organizations gain remarkable transactional efficiency through Workday’s state-of-the-art foundation. The platform’s built-in controls and audit capabilities ensure compliance while streamlining financial workflows.

Gartner recognizes Workday as a Leader in Cloud ERP for Service-Centric Enterprises, highlighting its strong market position. The platform’s continuous innovation in AI and automation keeps it at the forefront of enterprise financial management solutions.

5. Sage

Pros: Streamlined Financial Management, Improved Accuracy and Reduced Errors.

Cons: Limited Scalability, Limited Customization Options

Pricing: Sage UBS: Starting from RM50 for basic versions.

Usability: Wizard setup and transaction wizards provide step-by-step guidance for new users.

Sage stands as a leading provider of ERP and accounting software solutions, offering versatile options for businesses of every size. Their flagship products, Sage 50 and Sage Intacct, deliver robust financial management capabilities through both desktop and cloud-based platforms.

Sage 50 serves small businesses with essential features like cash flow tracking, invoice management, and expense monitoring. Its desktop-based system includes cloud connectivity options, making it flexible for teams who need remote access to their financial data.

The more advanced Sage Intacct targets mid-sized companies with complex accounting needs. This cloud-based solution excels at multi-currency transactions, bank reconciliation, and detailed analytical reporting. Companies using Sage Intacct report significant improvements in productivity and financial closing times.

Both platforms offer strong inventory management features, helping businesses track stock levels and optimize ordering processes. The software automates many routine accounting tasks, from payment processing to tax calculations.

A standout feature of Sage’s solutions is their comprehensive security measures. The platforms protect sensitive financial data through encrypted cloud storage and regular automatic backups.

The integration capabilities of Sage products deserve recognition. These systems connect smoothly with other business tools, creating a unified workflow for accounting, HR, and customer relationship management tasks.

6. Infor

Pros: Robust Multi-currency Support, Flexible Deployment Options.

Cons: Clunky User Interface, Lacks Mobile App.

Pricing: Infor does not publicly disclose its pricing information. However, it’s considered a more expensive alternative with a higher total cost of ownership compared to some other options.

Usability: Training may be necessary for staff to effectively use all features.

Infor stands as a robust ERP solution specializing in financial and accounting capabilities. This cloud-based system integrates seamlessly with various business processes while offering deep industry-specific functionality.

The platform excels at complex financial operations through its unified ledger system. Organizations can generate real-time reports, perform detailed analytics, and maintain compliance across multiple regulatory environments.

A standout feature of Infor is its ability to handle international operations. The software supports multiple languages and currencies, making it ideal for businesses with global reach. Teams can access financial data instantly, regardless of their location.

The user interface promotes smooth navigation and enhanced productivity. Built-in automation tools streamline data entry and invoice processing, while intelligent alerts keep teams informed of critical financial events.

Security and flexibility remain central to Infor’s design. The cloud infrastructure ensures data protection while allowing quick system updates and seamless integration with existing business tools.

The software adapts well to changing business needs and supports complex organizational structures. This flexibility proves valuable for companies experiencing growth or frequent restructuring.

7. Oracle NetSuite

Pros: Real-time visibility for Financial Data, Automated Core Accounting Processes.

Cons: Less-intuitive Help System, Complicated Setup.

Pricing: Starting from approximately RM 40,000 to RM 200,000 per year.

Usability: Comprehensive training may be required to fully utilize all features.

Oracle NetSuite stands as a powerful cloud-based ERP solution that transforms how businesses manage their financial operations. Its unified platform integrates essential functions like accounting, order processing, and inventory management into one seamless system.

The platform’s cloud accounting capabilities make it easy to handle day-to-day financial tasks. We particularly value its automated transaction recording and streamlined payables and receivables management.

NetSuite’s AI-powered features set it apart from traditional ERP systems. The software reduces manual data entry and automates repetitive tasks, leading to fewer errors and more efficient operations.

Supply chain and warehouse operations benefit from NetSuite’s real-time visibility tools. Teams can track inventory levels, monitor order fulfillment, and make data-driven decisions from a single dashboard.

The software excels in customization options. Businesses can tailor the platform to match their specific needs, from basic accounting to complex multi-entity financial management.

NetSuite’s comprehensive approach means businesses don’t need multiple software solutions. The platform handles everything from basic bookkeeping to complex enterprise resource planning in one unified system.

8. Unit4

Pros: Real-time Financial Information, Strong Reporting and Analysis Tools.

Cons: Occasional Performance Issues with Larger Data Volumes

Pricing: Full ERP Suite (one-time price for 500 FTE employees): Approximately MYR 835,266.

Usability: Might have a learning curve, especially for more advanced features, which could require additional training for Malaysian staff

Unit4 stands as a prominent cloud-based ERP solution crafted specifically for organizations experiencing constant change. Its ERP platform unifies finance, HR, and project management functions through a single, reliable source of truth.

The financial management capabilities shine through Unit4’s smart automation features. Teams can streamline accounting processes, handle procurement efficiently, and maintain precise billing systems while ensuring regulatory compliance.

Organizations gain powerful reporting tools to drive strategic decision-making. Real-time analytics and customizable dashboards put critical financial KPIs at everyone’s fingertips.

The platform excels in project management integration. Teams can track project finances, manage resources, and monitor progress seamlessly within the same system used for accounting and procurement.

A standout strength lies in Unit4’s adaptability. The modular design lets organizations scale and modify their ERP setup as business needs evolve, making it particularly valuable for growing enterprises.

Conclusion: SAP Business One The Definitive ERP Accounting Software For 2025

SAP Business One stands as the leading ERP solution for small and medium enterprises in 2025. We recognize its powerful integration of financial management, CRM, inventory tracking, and operational controls into one cohesive platform. Real-time data analytics and streamlined processes make it an invaluable tool for businesses seeking growth and efficiency.

And if you need further consultation from experts regarding how SAP Business One can be implemented and improved, be sure to contact our professionals at Aspert here!

Further reading:

Best Cloud ERP for Small Businesses