What Is Withholding Tax In Malaysia?

Withholding tax in Malaysia is a tax deducted at the source of payment for certain types of income paid to non-residents. As a payer in Malaysia, under the Income Tax Act 1967, you’re required to withhold a portion of the payment and remit it to the Inland Revenue Board (IRB).

This system ensures that the Malaysian government collects taxes on income derived from Malaysian sources by non-residents.

Businesses must deduct withholding tax from payments made to non-residents as required by Malaysian tax law. For the average Malaysian citizen, withholding tax generally doesn’t apply to your personal income.

However, if you’re a business owner or employer making payments to non-residents for services, royalties, or other specified income types, you’re responsible for withholding the appropriate tax amount which is now assisted through accounting or e-invoicing software.

The withholding tax rates vary depending on the type of income. For example, contract payments to non-residents are subject to a 10% withholding tax, while royalties typically incur a 10% rate.

It’s crucial to stay informed about the current rates and regulations to ensure compliance with Malaysian tax laws.

To get a full picture LHDN has a document about withholding tax here.

The Purpose of Withholding Tax

The purpose of withholding tax is to ensure that taxes are collected from non-residents who have derived income from Malaysian sources. The payer is required to withhold tax on behalf of the non-resident payee and remit it to the Inland Revenue Board of Malaysia (IRBM).

Types of Payments Subject to Withholding Tax

The following types of payments are subject to withholding tax in Malaysia:

- Interest paid to non-resident individuals or companies

- Royalties paid to non-resident individuals or companies

- Technical fees paid to non-resident individuals or companies

- Contract payments made to non-resident contractors

- Special classes of income, such as payments for services rendered by non-resident individuals or companies

- Payments made to non-resident public entertainers

Withholding Tax Rates Regarding Specified Payments In 2024

In Malaysia, withholding tax rates for specified payments remain consistent in 2024. As a non-resident receiving certain types of income from Malaysian sources, you’ll need to be aware of these rates.

Interest payments are subject to a 15% withholding tax. This applies to various forms of interest income you might receive from Malaysian entities.

Royalties face a 10% withholding tax rate. If you’re earning royalties from intellectual property or other assets in Malaysia, this rate will apply to your gross income.

For special classes of income, such as technical fees or rental of movable property, you’ll encounter a 10% withholding tax. This rate may be reduced if there’s a Double Taxation Agreement between Malaysia and your country of residence. A non-resident may benefit from reduced withholding tax rates if they are a tax resident of a country that has a double tax agreement with Malaysia.

Contract payments for services rendered in Malaysia are taxed at 10% plus 3% on the gross amount. This affects non-resident contractors providing services within the country.

Remember, these rates apply to gross payments. The Malaysian payer is responsible for deducting and remitting the tax to the Inland Revenue Board within one month of paying or crediting you.

What Are The Consequences And Penalties For Non-Deduction Or Non-Deposit Of Withholding Tax

Failing to pay withholding tax or remit it in Malaysia can lead to serious repercussions for your business. You’ll face hefty financial penalties that can significantly impact your bottom line.

The Lembaga Hasil Dalam Negeri Malaysia (LHDN) imposes a 10% late payment penalty on unpaid taxes. If you delay payment beyond 60 days, you may incur an additional 5% penalty.

Your tax deductions related to the withholding tax expense could be disallowed, further increasing your tax burden. In some cases, you might be liable for up to 45% of the original expenditure in additional taxes and penalties.

Legal consequences are equally severe. You could face fines ranging from RM200 to RM20,000 and even imprisonment for up to 6 months. The Director General may also impose a penalty equal to the amount of tax undercharged due to incorrect returns or information.

Non-compliance can disrupt your business operations. You’ll likely face cash flow issues due to unexpected penalties and taxes. The administrative burden of rectifying non-compliance can divert resources from your core business activities.

Long-term effects include increased scrutiny from tax authorities and potential reputational damage. This could harm your business relationships and future opportunities.

It is crucial to remit withholding tax within the required timeframe to avoid penalties and ensure compliance with Malaysian tax regulations.

To avoid these consequences, ensure timely and accurate withholding tax deductions and deposits. Proper tax planning is crucial for maintaining good standing with Malaysian tax authorities and safeguarding your business interests.

How To Calculate Withholding Tax

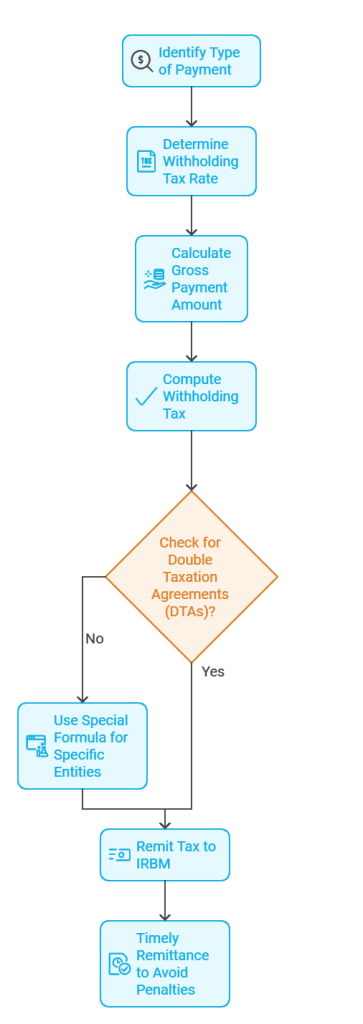

Calculating withholding tax in Malaysia requires attention to detail and an understanding of the specific rates for different types of payments.

You’ll need to follow a step-by-step process to ensure accuracy.

First, identify the type of payment you’re making to a non-resident. Common categories include interest, royalties, and technical fees. Each category has its own withholding tax rate.

For interest payments, the rate is typically 15%. Royalties are subject to a 10% rate. Technical fees and other special classes of income also carry a 10% rate.

Once you’ve determined the appropriate rate, apply it to the gross amount paid. The formula is straightforward:

The sums paid for services, royalties, or other specified income types must be accurately calculated to determine the correct withholding tax amount.

Let’s look at a practical example. If you’re paying RM50,000 for technical services to a foreign company, your calculation would be:

RM50,000 × 10% = RM5,000

This RM5,000 is the amount you’ll need to withhold and remit to the Inland Revenue Board of Malaysia (IRBM).

Remember to check for any applicable Double Taxation Agreements (DTAs). These agreements between Malaysia and other countries may allow for reduced rates in certain situations.

Timing is crucial when remitting withholding tax. You must pay it to the IRBM within one month of the payment date to the non-resident. Late payments can result in penalties, so mark your calendar accordingly.

How To Record Withholding Tax In Accounting

Recording withholding tax in accounting is crucial for businesses operating in Malaysia. You’ll need to follow specific steps to ensure accurate financial reporting and compliance with tax regulations.

Start by creating a liability account for withholding tax in your chart of accounts. This account will track the amount you owe to the Inland Revenue Board of Malaysia (LHDN).

When you make a payment subject to withholding tax, record the full amount as an expense. Simultaneously, credit the withholding tax liability account for the tax amount and the cash account for the net payment.

For example, if you pay RM 100,000 for technical services with a 10% withholding tax rate:

- Debit expense account: RM 100,000

- Credit withholding tax liability: RM 10,000

- Credit cash account: RM 90,000

Remember to remit the withheld tax to LHDN by the due date. When you pay, debit the withholding tax liability account and credit your cash account.

Keep detailed records of all transactions subject to withholding tax. Include information such as payment dates, amounts, recipients, and applicable tax rates. This documentation will be essential for tax reporting and potential audits.

An accounting software that we highly recommend is Aspert’s AiNexus e-invoice system to streamline and automate these processes. The best part is, it plays well with other software, making it not only easy to use but also easy to integrate to your existing systems.

The Disadvantages And Advantages Of Withholding Tax

Withholding tax in Malaysia offers both benefits and drawbacks for taxpayers and the government. Let’s explore these aspects to give you a clearer picture.

On the positive side, withholding tax ensures a steady flow of revenue for the Malaysian government. This system helps prevent tax evasion by collecting taxes at the source, particularly from non-resident individuals and companies.

For you as a taxpayer, withholding tax can simplify your tax obligations. It reduces the burden of having to save large sums for annual tax payments, as taxes are deducted incrementally throughout the year.

The system also promotes fairness in taxation. It ensures that non-residents contributing to the Malaysian economy pay their fair share of taxes on income derived from the country.

However, withholding tax does have its downsides. For businesses, it can create additional administrative work and costs. You’ll need to calculate, deduct, and remit the correct amount of tax for various types of payments.

Further reading: How to Make Accounting Easy With SAP Accounting Software

There’s also the risk of over-withholding, which can tie up your cash flow unnecessarily. In such cases, you may need to go through the process of claiming refunds, which can be time-consuming.

For non-residents, withholding tax might result in double taxation if their home country doesn’t have a tax treaty with Malaysia. This could discourage foreign investment and expertise in the Malaysian market.

Lastly, the complexity of withholding tax rates and rules can lead to unintentional non-compliance. You might face penalties if you misinterpret or incorrectly apply the regulations.

Wrapping Up

Withholding tax in Malaysia plays a crucial role in the country’s tax system. You’ve learned about its purpose, rates, and application to various types of payments. Remember to stay updated on current regulations, as tax laws can change.

Seeking professional advice can be invaluable, especially for complex transactions or international dealings. Better yet, using software to help automate things can be an easier route for large corporations and if you do need advise in picking one, feel free to contact our experts here.