About E-Invoice And Its Conveniences

E-invoices, or electronic invoices, have revolutionized the way businesses manage their transactions.

Physical papers and documentation have become things of the past that have benefitted both small to medium enterprises (SMEs) and large corporations.

By adopting digital invoicing, you can enjoy increased efficiency and accuracy in financial processes.

The primary advantage of e-invoicing through AI lies in the automation of invoicing tasks. This reduces manual data entry, which not only minimizes errors but also speeds up transaction processing times.

For businesses in Malaysia shifting to e-invoicing, this means an enhanced workflow where resources are better allocated, and employees can focus on more strategic tasks rather than mundane paperwork.

Marrying both transparency and speed, e-invoicing has enabled instant access to transaction details, facilitating smoother communication and better financial planning.

As an extension, using e-invoices can lead to significant cost savings. When you switch to electronic invoices, the costs related to printing and mailing are eliminated.

Digital storage of invoices reduces the need for physical space to store paper documents, which can be both cumbersome and expensive to maintain.

We’re sure accounting veterans can attest to this because physical documentation is very inefficient in the modern day.

Security is another key benefit. Since e-invoices are digitalised, encryption is on the table. This ensures iron-clad protection of sensitive financial data against unauthorized access.

With the growing concerns over data breaches, this added layer of security in electronic invoicing is especially important for maintaining trust with your clients and partners.

Read and learn more about AI integration for e-invoicing at: https://aspert.com.my/beginners-guide-to-e-invoicing/

Required Transactions For E-Invoice Generation

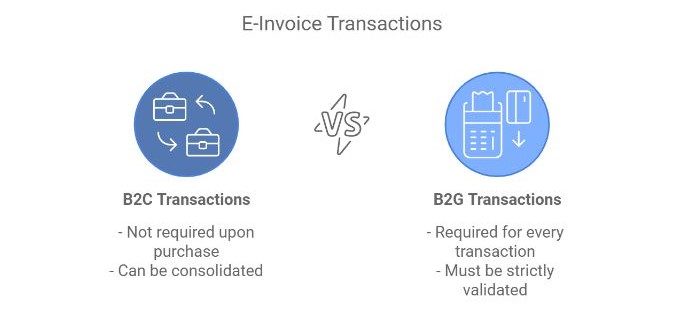

In Malaysia, certain type of transactions can be done via different e-invoice processes.

In Malaysia, e-invoices have become essential for various types of transactions. For business-to-consumer (B2C) transactions, e-invoices are mandated for all interactions.

Yet, many buyers, like individual consumers, might not require an e-invoice upon purchase. In such cases, sellers can opt to consolidate these transactions into a monthly e-invoice.

Business-to-government (B2G) transactions also demand the use of e-invoices. Engaging with government entities through a structured digital invoice system enhances accountability and transparency.

Each transaction must be recorded accurately in the required digital format and submitted for validation through the appropriate channels.

For both transaction types, businesses can choose to use either the MyInvois Portal or use an e-invoicing software for seamless submission. This flexibility helps accommodate businesses of varying sizes and technological capabilities while ensuring compliance with mandatory e-invoicing protocols.

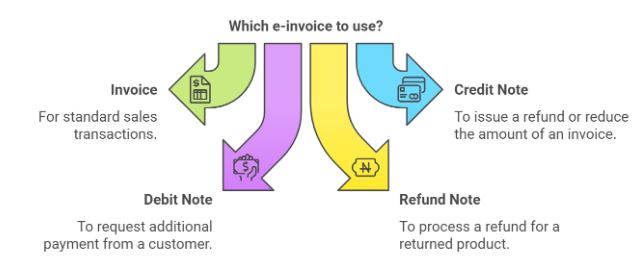

The Different Types Of E-Invoices

In Malaysia, certain type of transactions can be done via different e-invoice processes.

In Malaysia, e-invoicing is tailored to accommodate the diverse requirements of various transaction scenarios.

Usually, there are four different types of e-invoices which are commonly used and referred in business dealings in Malaysia.

The four types of e-invoices we are referring to are:

- Invoices

- Credit Notes

- Debit Notes

- Refund Notes

While they serve different purposes, each of these e-invoices is somewhat interconnected. Moving forward, we will be going into detail about how each e-invoice operates and how you can apply them in specific scenarios.

1. Invoices

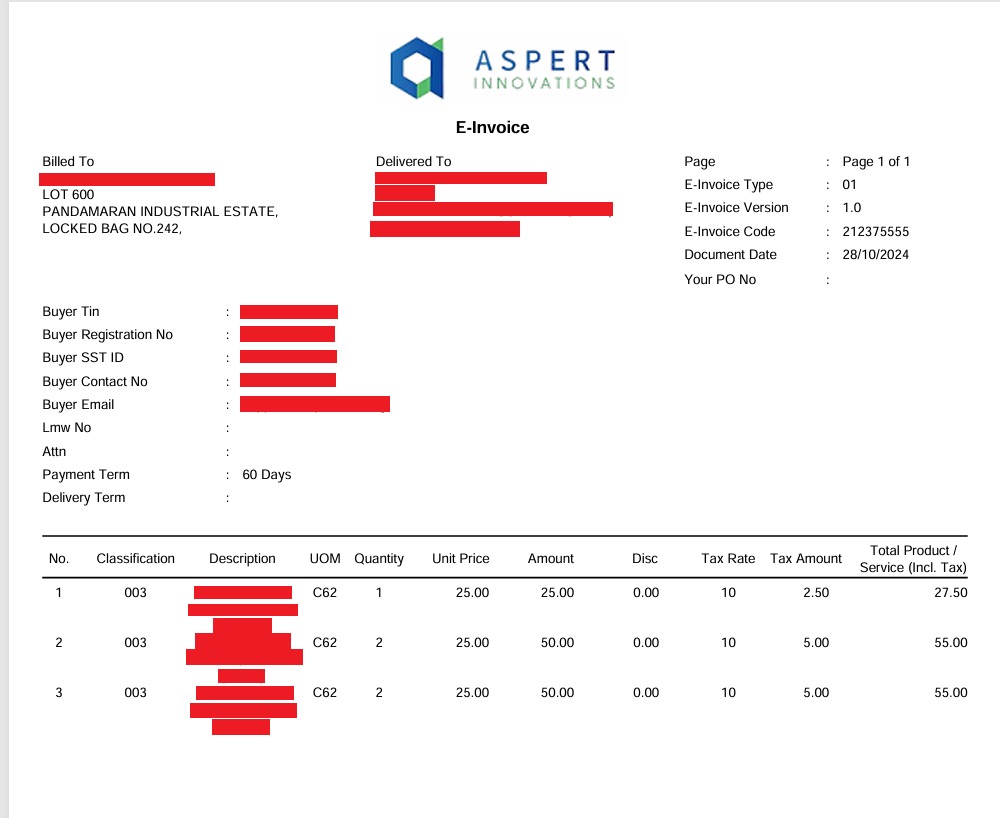

Invoices serve as a fundamental record of transactions between buyers and sellers.

They include details such as the items or services provided, the prices, and payment terms. This document is essential for both parties to ensure transparency and accuracy in their financial dealings. An invoice acts as a formal request for payment and is a crucial part of business operations.

A typical invoice consists of several components:

- Buyer and Seller Information: Names, addresses, and contact details.

- Invoice Number: A unique identifier for tracking and reference.

- Itemized List: Products or services provided, with descriptions and quantities.

- Total Amount Due: The cumulative total, including taxes and discounts.

Self-billed invoices are a particular type where the buyer generates the invoice instead of the seller. This method simplifies the invoicing process for both parties, reducing the need for back-and-forth communication. It’s commonly used in situations where regular transactions occur under predefined terms.

Invoices are not merely about money exchange. They ensure both parties comply with contractual obligations and facilitate smooth financial management.

When an invoice is issued, it signifies the completion of a sale or service, moving business interactions from agreement to transaction.

Understanding the structure and purpose of invoices enhances your business acumen, paving the way for efficient operations. Keep this in mind as you manage financial transactions, trimming down errors and ensuring accountability on both sides.

2. Credit Notes

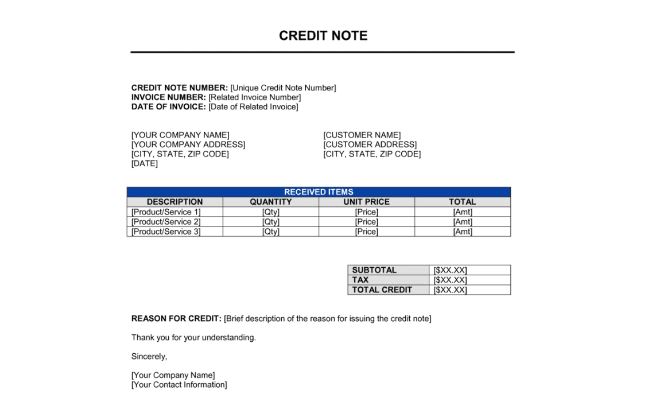

Imagine you receive an e-Invoice, and something doesn’t add up—maybe the amount is incorrect, or perhaps some items need to be returned.

How do businesses handle such discrepancies?

That’s where credit notes come into play.

A credit note is a vital document issued by sellers to correct errors in a previously issued e-Invoice. Its main purpose is to lower the value of the original invoice without having to return money to the buyer.

You might find errors due to overcharges or even as the result of discounts that apply after the initial sale. In such cases, issuing a credit note allows you to adjust the invoice value appropriately.

When you purchase goods and later return some, a credit note is often used to account for these returns.

Think of it as adjusting the financial balance between the seller and you, making sure everything adds up as it should.

Credit notes are detailed, indicating amounts to be credited to your account, ensuring transparency.

This method helps maintain accurate documentation and provides a fair accounting process between you and sellers.

By clarifying and correcting financial transactions, credit notes play a crucial role in business accounting systems. They maintain fairness and facilitate smooth business operations.

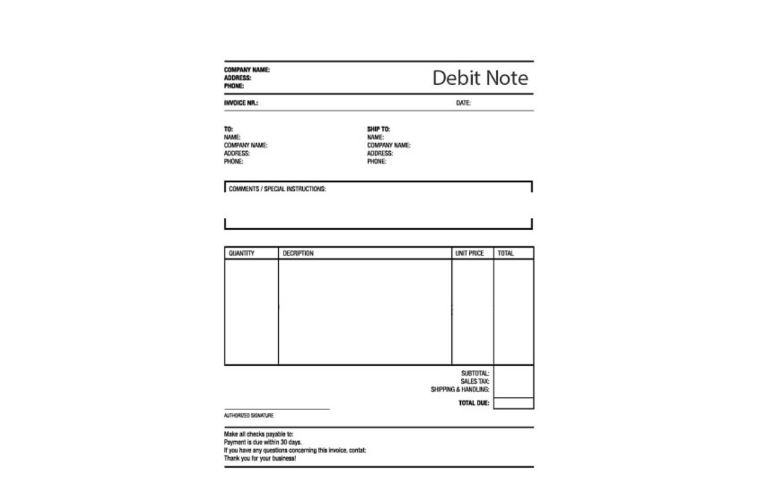

3. Debit Notes

When it comes to managing finances in the e-invoice era, debit notes hold a special place. They are distinct from credit notes and play an essential role in adjusting accounts.

Unlike a credit note, which typically reduces the amount a buyer owes, a debit note signifies additional charges to a previously issued e-invoice.

A debit note might be issued when there are unforeseen costs or omissions.

For instance, imagine you ordered 100 units of a product, but the supplier accidentally shipped 150 without adjusting the original invoice. In this scenario, a debit note can be issued for the additional 50 units.

Issuing a debit note allows both parties to remain aligned on updated transactions in the e-invoicing system.

It clearly indicates the added expenses, ensuring transparency and mutual agreement on financial adjustments.

A simple comparison:

- Credit Note: Reduces customer liability.

- Debit Note: Increases the amount due to additional charges.

Knowing these differences can help streamline your accounting process and support smooth business operations.

Visualising these documents as part of your digital transaction toolbox is crucial in the modern business landscape.

Incorporating debit notes effectively ensures proper management of additional costs and fosters clear communication between buyers and sellers.

This clarity is crucial for maintaining a healthy business relationship, especially when dealing with electronic systems that record every transaction detail.

4. Refund Notes

A refund e-invoice is an official document issued by a seller to record a refund granted to a buyer.

It acts as proof of a transaction reversal, ensuring transparency and proper documentation within the financial system. It’s essential for managing finances accurately and adhering to legal requirements.

Imagine you purchased a piece of furniture online, but upon delivery, you noticed it was damaged. After contacting customer service, the seller agrees to a refund.

To facilitate this, they issue you a refund e-invoice. This document not only confirms the refund process but also aligns it with the relevant tax and accounting protocols.

Refund notes are crucial in distinguishing between returns and adjustments in accounting records. They prevent potential discrepancies by processing refunds in a standardised manner.

Every refund note needs to reference the original invoice to which it relates, maintaining a trail for financial audits.

Engaging with refund notes through the digital system, such as the MyInvois Portal, simplifies their issuance.

Users are guided through a step-by-step process, ensuring all necessary information is accurately captured and communicated back to the buyer. This system enhances efficiency, reducing the possibility of errors.

Refund notes are indispensable in precise financial management, forming a clear link between refunds and original transactions.

They play a pivotal role in transparent record-keeping. By understanding this, you can better appreciate the role they play in maintaining orderly financial transactions.

Wrapping Up

Now that we’ve gone through the technical prowess of e-invoicing, it is almost imperative for modern businesses to utilise it to its full potential.

To achieve such potential, relying on a dedicated e-invoicing software with AI integration like AiNexus can help tremendously.

Through Aspert’s AiNexus, you’ll likely find fewer errors and a more streamlined workflow when adopting this digital method.

Its features will also help e-invoicing with compliance, particularly with guidelines set by local tax authorities, such as those detailed by Lembaga Hasil Dalam Negeri Malaysia.

By taking these steps, you’re aligning your business with future-ready practices while ensuring accuracy and efficiency.

With that said, if your business still needs a hand with e-invoice processing, be sure to reach out to our experts and we will do our best to figure out the ideal e-invoicing solution here!