Since early 2024, the concept of e-invoicing has gained traction among businesses of all sizes. If you’re unsure about what e-invoicing entails, you’ve come to the right place. Let us explain it to you.

Malaysia and e-Invoicing

Malaysia is set to introduce mandatory electronic invoicing for Sales and Services Taxes starting from 1 August 2024. This initiative was first announced by the Ministry of Finance in the 2023 Pre-Budget statement, aiming to digitize and streamline tax administration processes.

What is an e-invoice?

Think of your usual paper and electronic invoices, but fully digital. An e-invoice is a digital representation of transactions between buyers and sellers for B2B, B2C, and B2G transactions. It is designed to replace traditional paper invoices and credit notes with a modern, more effective system. The Inland Revenue Board of Malaysia (IRBM) will specify the format that e-invoices must follow to ensure compatibility and processability by their system.

Why switch to e-Invoicing?

e-invoicing is a key initiative under the Twelfth Malaysia Plan to digitalize tax administration. The primary motivation is to eliminate paper invoicing and prevent common issues like tax leakage. Additionally, e-invoicing simplifies processes for businesses involved in international trade. By standardizing invoices into a digital format, both the government and businesses can manage invoices more efficiently. Enhanced tax compliance is another benefit, as e-invoicing allows for better, easier, and more accurate tax reporting. For businesses, e-invoicing can significantly save time, enhance efficiency, and minimize human errors by reducing the need for manually creating paper invoices.

Where are you in the implementation timeline?

To ensure a smooth transition, the IRBM has divided the implementation into three phases:

Phase 1: Businesses with an annual turnover of more than RM100 million must comply with e-invoicing by 1 August 2024.

Phase 2: Businesses with an annual turnover between RM25 million to RM100 million must adopt e-invoicing by 1 January 2025.

Phase 3: All taxpayers must implement e-invoicing by 1 July 2025.

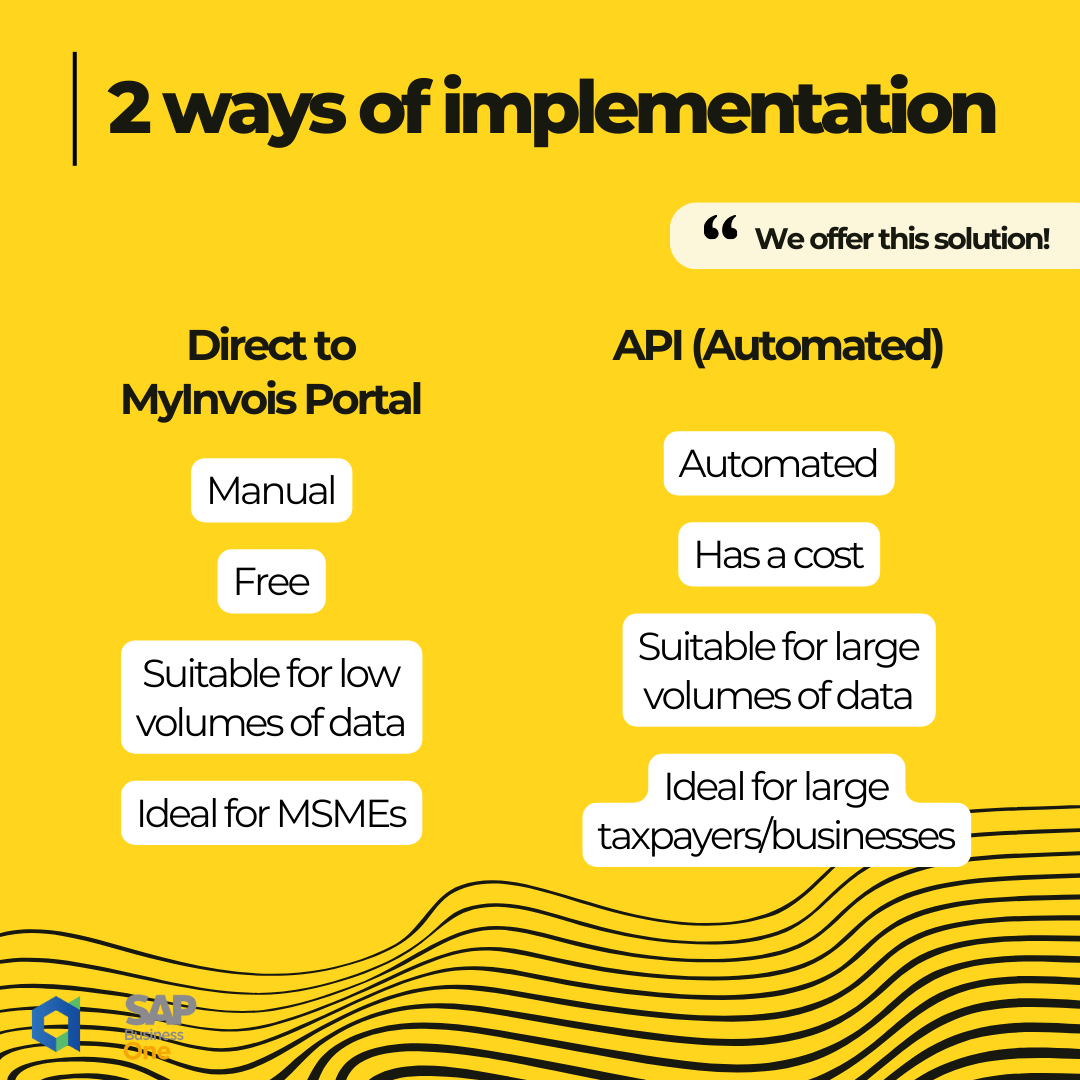

2 methods of implementation

I. Direct to MyInvois Portal

This method is suitable for MSMEs with low volumes of data. It involves manually creating and submitting e-invoices to the MyInvois Portal. The best part is, it’s free!

II. Through API (Automated)

API (Application Programming Interface) involves using a platform or service provided by technical companies to automate the e-invoicing process. This method is ideal for businesses with large volumes of data and requires an investment in the solution provided by these companies. At Aspert Innovations, we offer automated solutions to help businesses increase efficiency and streamline their processes.

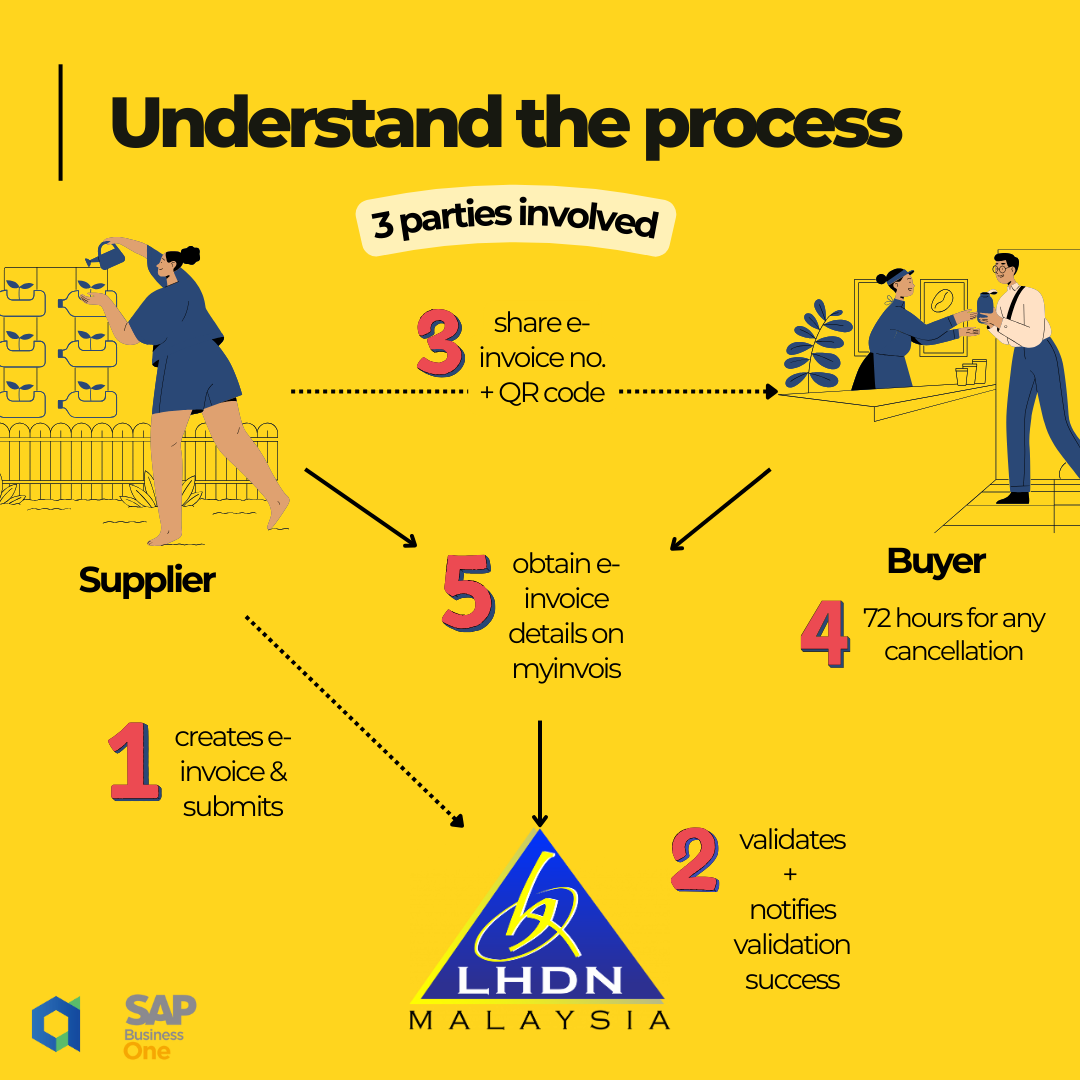

Let's understand the process/workflow

- Creation: When a transaction occurs, the supplier creates an e-invoice and submits it either manually to the MyInvois Portal or through API for IRBM validation.

- Validation: IRBM validates the e-invoice, ensuring it meets the necessary requirements and standards, usually in near real-time.

- Unique ID Issuance: Once validated, the supplier receives a unique ID for the e-invoice from IRBM, ensuring traceability and preventing tampering. IRBM also notifies both the supplier and the buyer of the validation.

- Issuance: The supplier must issue or share the validated e-invoice, complete with an embedded QR code, to the buyer.

- Review Period: Both parties have 72 hours to cancel or reject the e-invoice if needed, with justifications required for rejection.

- Confirmation: After 72 hours, both the supplier and buyer can access the confirmed e-invoice details on the MyInvois Portal.

By transitioning to e-invoicing, businesses in Malaysia can look forward to a more efficient, accurate, and streamlined invoicing process, aligning with global standards and enhancing overall productivity.

For more information check out: e-Invoice | Lembaga Hasil Dalam Negeri Malaysia

Let us help! Feel free to contact us for consultation or details about our very own e-Invoicing API solution.